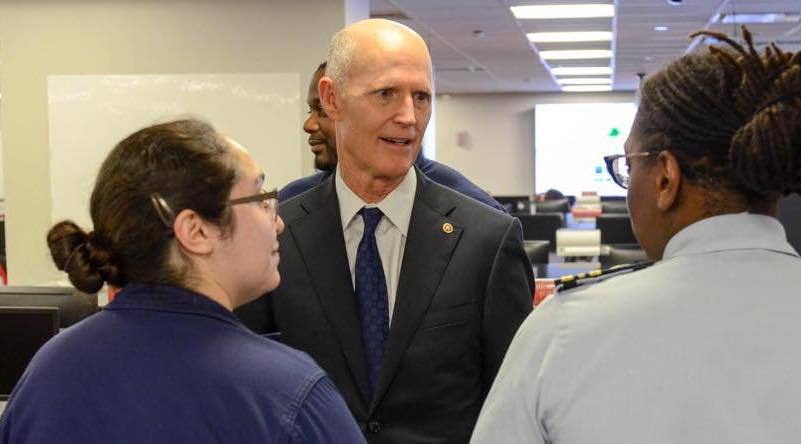

U.S. Sen. Rick Scott | Facebook

U.S. Sen. Rick Scott | Facebook

Expert projections say life is about to get very expensive for Americans, and two legislators are calling for action before it's too late.

U.S. Senator Rick Scott (R-FL) is among the lawmakers alarmed at the bleak inflation outlook. In a May 21 op-ed co-authored with Sen. Cynthia Lummis (R-WY), Scott stated that Biden will try to "tax his way out of his own massive spending problem" in a way that will have destructive impacts on the economy.

"Fiscally conservative citizens and elected officials must do everything in our power to reverse the direction of our deficit and debt spending," Scott and Lummis wrote in the column. "The future of our children and grandchildren depend on our actions."

The Congressional Budget Office released a report predicting that if the current tax and spending laws don’t change by 2031, the U.S. National Debt will reach 107% of the GDP, the highest level in U.S. history.

The consequence of the federal spending machine is inflation, which is a spike in the cost of consumer goods such as food, gasoline and more. Inflation is projected to rise by over 60% from its pre-COVID low of 1.4% to 2.3% or more.

Inflation disproportionately affects low-income Americans, according to Scott. According to a Shopkick survey, 83% of Americans are tightening their budget this year due to inflationary pressures, and 54% are “very worried” about inflation.

The survey also found that more than 90% of respondents noted an increase in grocery and gas spending since Biden took office.

The Congressional Budget Office report also states that the current federal debt held by the public, which was 100% of the U.S. GDP at the end of the fiscal year 2020, is projected to reach 102% of GDP by the end of 2021.

In a letter to his colleagues earlier this year, Scott urged Congress to get a hold of this problem. He warned that the national debt, which currently stands at over $27 trillion, amounting to over $225,000 per American, is rising at the highest rate in American history.

In order to combat the problem, Scott urges Washington to decrease spending and resist the temptation to raise the debt ceiling.

Spending has certainly not been decreased to date. The United States Money supply has increased by 40% since the beginning of the COVID-19 crisis. Before the period of high inflation of the 1970s, the money supply had increased by just 13%.

Scott is not the only one sounding the alarm. Former Clinton administration Treasury Secretary Lawrence Summers warned the recent economic stimulus passed by the Biden administration will likely “set off inflationary pressures of a kind we have not seen in a generation," according to The Federalist.

Scott was among the lawmakers to present the Pay Down the Debt Act, which would redirect unused federal grant funding to be used for paying down debt.

In his op-ed, Scott referred to the legislation as "a real step to start reining in spending and reducing our debt."

Alerts Sign-up

Alerts Sign-up